Mortgage Calculator

How to Calculate Your Mortgage Payment

Calculating mortgage payments can be complex, but Agape's Mortgage Calculator simplifies the process.

Start by entering the "Purchase Price" — this is the price of the home you're buying or the current value of your home if you're refinancing.

Next, in the "Down Payment" section, input the amount you're paying upfront (for buyers) or the equity you have in your home (for refinancers). A down payment is the initial cash paid on a home, while equity is the difference between the home's value and what you owe.

Then, select your "Term," usually 30 years, but it could also be 20, 15, or 10 years, and the calculator will adjust the repayment schedule accordingly.

In the "Interest Rate" box, enter the rate you expect to pay. The calculator defaults to the average current rate, but you can adjust it based on your loan situation.

As you input these details, the calculator will provide an estimated monthly payment for principal and interest. It will also estimate property taxes, homeowners insurance, and HOA fees, which you can adjust or leave out if they’re included in your escrow payments. These figures won’t affect the principal and interest calculation but are helpful as you shop for a loan.

Costs Normally in Your Mortgage Payment

Your mortgage payment consists of several key components, primarily the principal and interest. The principal is the amount you borrowed, and the interest is the fee you pay to the lender for the loan. Additionally, your lender may collect an extra amount each month to fund an escrow account, which is used to pay for property taxes and insurance on your behalf.

- Principal: The amount of money you borrowed from the lender.

- Interest: The cost of borrowing the money, expressed as an annual percentage rate.

- Property Taxes: Local governments assess annual taxes on your property. If you have an escrow account, you pay a portion of your annual tax bill each month.

- Homeowners Insurance: This insurance covers damage or losses from incidents like fire, storms, theft, and more. If you're in a flood zone or an area prone to certain natural disasters, you may also need additional insurance. You pay a portion of your annual premium each month, which the lender pays when due.

- Mortgage Insurance: If your down payment is less than 20%, you’ll likely be required to pay for mortgage insurance, which will also be included in your monthly payment.

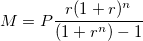

Mortgage Payment Formula

| Symbol | Meaning |

|---|---|

| M | the total monthly mortgage payment |

| P | the principal loan amount |

| r | your monthly interest rate Lenders give you an annual interest rate, which you can divide by 12 (the number of months in a year) to calculate the monthly rate. For example, if your interest rate is 5 percent, your monthly rate would be 0.004167 (0.05 ÷ 12 = 0.004167). |

| n | number of payments over the loan’s lifetime To calculate the total number of payments for your loan, multiply the loan term in years by 12 (the number of months in a year). For instance, a 30-year fixed mortgage would require 360 payments (30 × 12 = 360). |

This formula helps you figure out how much house fits your budget. To make it even easier, try using our Mortgage Calculator—it simplifies the process and shows whether your down payment is sufficient or if adjusting your loan term might make sense. Don’t forget to shop around with multiple lenders to ensure you’re getting the best possible deal.

How a Mortgage Calculator Can Help

Setting your housing budget starts with understanding your monthly house payment, likely your biggest ongoing expense. Agape's Mortgage Calculator makes it easy to estimate your payment, whether you’re shopping for a purchase loan or refinancing. Adjust the details in the calculator to explore different scenarios and make informed decisions, such as:

Choosing the right loan term:

If your budget is tight, a 30-year fixed-rate mortgage may be the best option. It offers lower monthly payments, though you'll pay more interest over time. If your budget allows, a 15-year fixed-rate mortgage can save you on interest, but the monthly payment will be higher.Deciding if an ARM fits your needs:

With rising rates, adjustable-rate mortgages (ARMs) might catch your eye. They often have lower initial rates than fixed-rate loans. For example, a 5/6 ARM has a fixed rate for the first five years, adjusting every six months after that. This could be a smart choice if you plan to move within a few years. However, be mindful of potential payment increases once the introductory rate ends.Ensuring affordability:

The Mortgage Calculator breaks down your monthly costs, including taxes and insurance, helping you gauge if your payment is within your budget.Determining your down payment:

While a 20% down payment is often considered the gold standard, it's not mandatory. Many buyers start with as little as 3%, depending on their financial situation.

Let the Mortgage Calculator guide you in planning a home purchase that aligns with your goals and budget.

Deciding How Much House You Can Afford

If you’re unsure how much of your income to allocate for housing, consider the 28/36 percent rule—a reliable guideline recommended by many financial advisors. According to this rule:

- Housing costs (like rent or mortgage payments) should not exceed 28% of your gross income.

- Total debt obligations (including mortgage payments, credit cards, student loans, medical bills, etc.) should stay under 36% of your gross income.

Here’s an example of how this breaks down:

Mark makes $72,000 a year. That's a gross monthly income of $6,000 a month. $6,000 x 0.28 = $1,680 total monthly mortgage payment (PITI)

How to Lower Your Monthly Mortgage Payment

If the monthly payment from our calculator feels a bit too steep, there are several strategies you can try to lower it:

- Opt for a longer loan term: Extending the term of your loan reduces your monthly payment, though you’ll pay more in interest over time.

- Spend less on the home: Borrowing less means smaller monthly mortgage payments, helping to keep costs manageable.

- Avoid private mortgage insurance (PMI): A 20% down payment (or 20% equity for a refinance) lets you skip PMI, which can significantly reduce your overall costs.

- Shop for a lower interest rate: Look for competitive rates, but keep in mind that the lowest rates may require paying points upfront.

- Increase your down payment: Putting more money down reduces the loan amount, which in turn lowers your monthly payment.

Experiment with these variables to find a payment plan that fits your budget.

Next Steps

A mortgage calculator is a valuable tool for estimating your monthly payment and understanding its components. Once you’ve crunched the numbers, here’s what to do next:

- Get pre-approved by a mortgage lender: This is a crucial step if you’re actively house hunting, as it demonstrates to sellers that you’re a serious buyer and helps define your budget.

- Apply for a mortgage. After the lender reviews your employment, income, credit, and financial situation, you’ll gain a clear understanding of how much you can borrow and the funds required at closing.

These steps turn your financial plans into actionable progress toward homeownership.

Mortgage Calculator: Alternative Uses

Plan to pay off your mortgage early:

Take advantage of the "Extra Payments" feature in Agape's mortgage calculator to explore how paying extra toward your loan principal can save you money in the long run and shorten your term. You can schedule extra payments monthly, annually, or as a one-time contribution.- To calculate your savings, click on "Amortization / Payment Schedule," input a hypothetical extra payment (monthly, yearly, or one-time), and hit "Apply Extra Payments." You’ll see how much interest you’ll save and when your loan will be paid off.

Decide if an ARM is worth the risk:

Adjustable-rate mortgages (ARMs) often come with lower initial interest rates, which can be appealing. However, their long-term cost and payment variability may not always deliver the savings you expect.- To compare, input the ARM’s interest rate into the calculator with a 30-year term. Then, run the numbers again using the interest rate for a conventional 30-year fixed mortgage. This comparison can help you weigh the benefits and risks of an ARM more clearly.

Determine when you can drop private mortgage insurance (PMI):

Use the calculator to figure out when you’ll reach 20% equity in your home, which is the threshold for asking your lender to waive PMI. If you put down less than 20% when you purchased your home, you’re likely paying an extra monthly fee for PMI to protect the lender’s risk. Once you hit 20% equity, that fee disappears, putting more money back in your pocket.

These features of the mortgage calculator can help you make smarter financial decisions and save money over time.

Terms Explained

- 30-year loan: Common for homebuyers, offering lower monthly payments by spreading the cost over three decades.

- 15-year loan: Popular for refinancers or those looking to save on interest. While it reduces total interest paid, monthly payments are higher, which can strain some budgets, especially for first-time buyers.

- Interest rate - You can estimate this by speaking to one of our pros. Once you have a projected rate (actual rates will depend on your financial and credit profile), enter it into the calculator.

- Loan start date - Enter the expected month, day, and year your mortgage payments will begin.

- Interest rate - You can estimate this by speaking to one of our pros. Once you have a projected rate (actual rates will depend on your financial and credit profile), enter it into the calculator.

- Loan start date - Enter the expected month, day, and year your mortgage payments will begin.

With these inputs, the calculator can give you a clear picture of your potential mortgage costs, helping you make informed decisions about your home financing options.